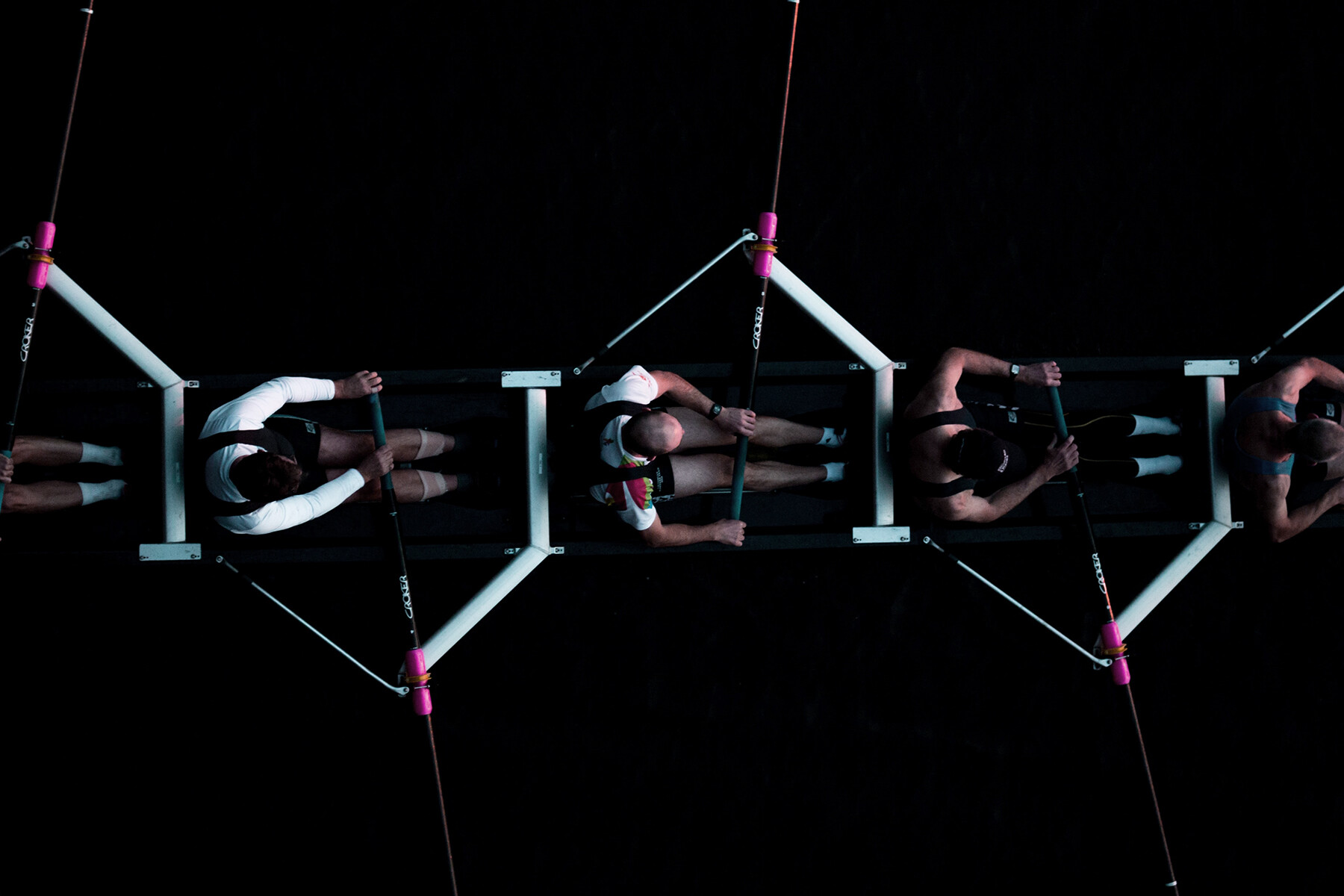

Laurus Property Partners offers the highest quality fund raising and execution in the market. Our business is based on long-term relationships with clients such as private equity funds, investment managers, property companies, closed-end funds, developers, corporates, family offices and asset managers.

The firm is managed by Oliver J. Richter, Matthias Dahmen, Andrew Wheldon, Richard Day and Gerardo Manrique, who together have over 100 years of industry experience and have closed in excess of €30 billion of transactions across all asset classes and European jurisdictions.

Our relationships with capital partners (such as banks, insurance companies, pension funds, institutional alternative lenders, debt funds, investment banks, family offices and private equity funds) are either at CEO/Board level or with the respective Head of Lending/Head of Investment.

MANAGEMENT

Matthias Dahmen

Managing Partner / Munich

Oliver Richter

Managing Partner / Munich

Andrew Wheldon

Managing Director / London

Richard Day

Managing Director / London

Gerardo Manrique

Managing Director / Madrid

Ian Goldsworthy

Senior Advisor UK & Ireland / London

Some of our Clients:

Client Testimonials:

“Laurus Property Partners were instrumental in ensuring that the refinance completed due to their high level relationships, an intensive interaction with the senior and junior lenders to aid the agreement of the inter-creditor position, their attention to detail on the legal documentation and involvement in regard of satisfying the conditions precedent.”

Chief Executive Officer – Pan-European Fund Management Group

“Laurus Property Partners have been instrumental in securing competitive and flexible finance for our projects. They combine excellent intellectual competency with strong market knowledge and effective market contacts.”

Founder & Managing Partner – UK Private Equity Fund

“Laurus Property Partners offered us an excellent bespoke service; they are very familiar with key industry players and were able to procure competitive funding offers – in line with our requirements – within a tight timetable. Their combination of experience, professionalism and uncomplicated approach suited our needs and I would therefore have no hesitation recommending them.”

Chief Executive Officer – Asian Family Office

LAURUS

PROPERTY PARTNERS

MUNICH

Maximilianstraße 36

80539 Munich

+49 (0) 173 524 5810

munich@laurus-property.com

LONDON

1 Warwick Street

London, W1B 5LR

+44 (0) 73 9703 3308

london@laurus-property.com

MADRID

Calle de Velazquez 34

Madrid, 28001

+34 (0) 603 824 821

madrid@laurus-property.com